The Privilege To Help

Guest post by OnRamp board member Austin Rogers

For lower-income Americans, the struggle to stay above water keeps getting tougher. That is especially true for hard-working individuals who don’t own a personal vehicle, as was the case for OnRamp clients before receiving the keys to their new car on donation day.

According to the most recent data, about 8% of US households do not own a personal vehicle. While some of these households don't need a vehicle because they have easy access to public transportation, most of these households in communities like ours would desperately like to own a car. They simply can't afford one.

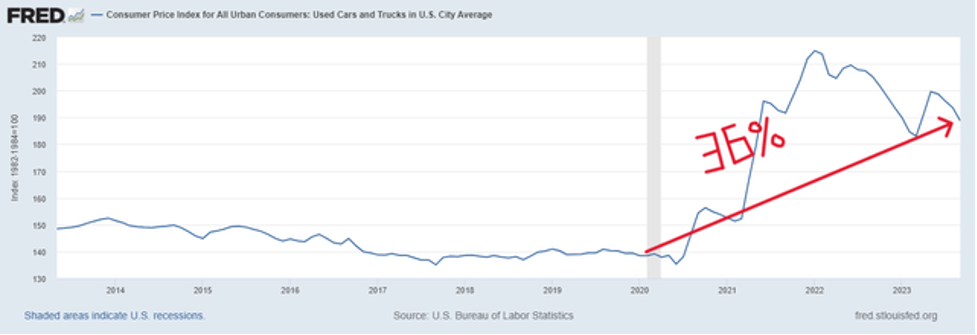

Since the beginning of COVID-19, prices for both new and used vehicles have soared. The average price of a used vehicle has leaped by 36% since the pandemic began. Even after a modest pullback in used car prices since their peak in early 2022, they remain much more expensive than they were 3-4 years ago.

Graph of Used Vehicle Prices:

Due to this jump in used car prices combined with an increase in interest rates, the average monthly car payment for used vehicles has soared 35% since 2020 to a high of $567.

That increase in vehicle costs comes on top of significant increases in the costs of essential goods like food and rent. The result is that even with growth in wages in the US these last few years, many hard-working, lower-income families feel like they are trapped in a hamster wheel, earning more money only to spend more money at the grocery store, gas pump, and car dealership.

As a result of these increased expenses, only about 40% of American households are able to save money at all. We know this from surveys like this one showing that 62% of Americans live paycheck to paycheck. The vast majority of those living paycheck to paycheck are in lower- or middle-income households. Many of these households are not only unable to save money, they are increasingly running up their credit card balances in order to survive. That is why we have seen total credit card debt in the US surge to a new record high of over $1 trillion.

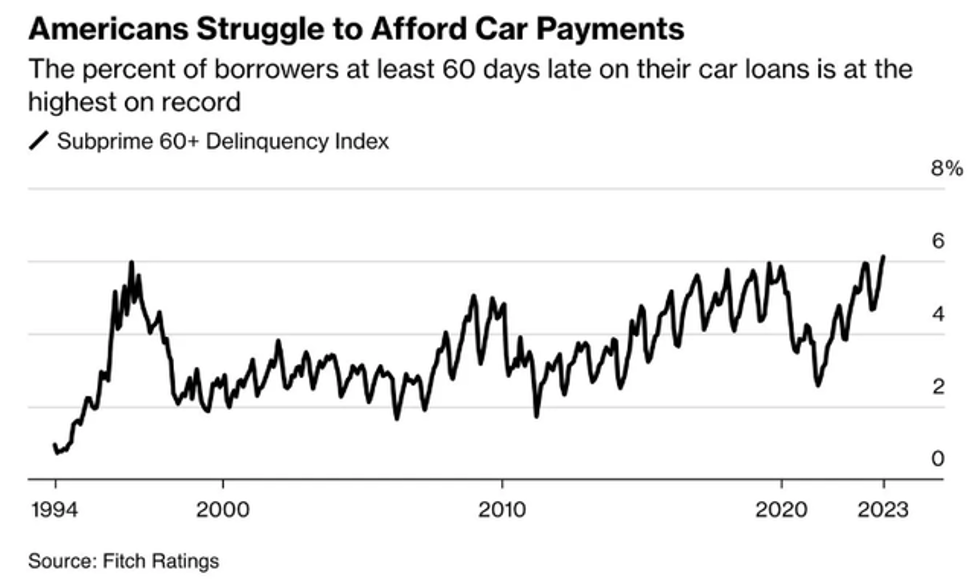

As prices and debts increase, it's no wonder that many Americans with car loans are falling behind on their payments and, unfortunately, seeing their vehicles repossessed by the lender. More auto loan borrowers with low credit ratings are missing their payments today than at any time in the last three decades.

In some cases, people bought more expensive cars than they could realistically afford. In other cases, borrowers fell prey to disreputable lenders or scam artists tricking them into outsize loans or dysfunctional cars that needed expensive repairs.

Whatever the causes, lower-income Americans are struggling even more than before the pandemic to keep their head above water in these difficult times.

A Call To Those With Means To Help

In 2 Corinthians 8, Paul tells us that Christians in Macedonia gave generously to help alleviate the suffering of their fellow believers in Jerusalem who were enduring great hardships. He praises the Macedonia Christians for giving so generously when they themselves had very little to give!

Paul says that the Macedonian Christians gave "of their own accord, begging us earnestly for the favor of taking part in the relief of the saints" (v. 4).

The Greek word for "favor" is charis, which can mean grace, goodwill, kindness, or favor. They didn't view charity (a word that derives from charis) as an obligation but as a joyful privilege.

How much more, then, should the relatively wealthy Corinthian church be motivated to give to their brothers and sisters in need?

"For I do not mean that others should be eased and you burdened," Paul writes in verses 13-14, "but that as a matter of fairness, your abundance at the present time should supply their need, so that their abundance may supply your need, that there may be fairness."

Paul's words are just as true for Americans today as they were for Corinthians 2,000 years ago. Some of us are blessed with resources to spare, and we have the privilege of participating in the relief of hard-working people in need right here within our community.

Although we are burdened by the difficulties many of our lower-income neighbors are going through, it gives us joy to be in a position to help. We would love to share this JOY with you, and so we invite you to financially partner with OnRamp. If you are blessed to have more than your family needs to survive, would you consider sharing some of that through OnRamp with families in need? Details can be found at www.onramptx.org/give.

PS. If you are ever looking to buy a used car for yourself or someone in your family, you will be tremendously well served by reading our free e-book Reliable Rides: OnRamp's Used Car Buying Guide. This will help you avoid the scams, lemons, and crooks so common in today’s used car market. Get your free copy on our www.onramptx.org/resources page.