Guest Post: Inflation's Pernicious Impact On The Poor

Guest post by OnRamp Board Member and Grant Committee Writer, Austin Rogers.

In the month of June 2022, two things rose higher than anyone would have liked:

Temperatures outside, and

The prices of almost everything.

The Bureau of Labor Statistics reported recently that consumer prices spiked by an average of 9.1% year-over-year in June 2022. That is the highest increase in the consumer price index ("CPI") in 40 years!

While rising prices at the grocery store, the gas station, and the shopping mall affect all of us, it is important to realize that they don't affect all of us equally. The poor are hit particularly hard by inflation - far harder than those with higher incomes and more resources at their disposal.

And household incomes have by and large not risen in tandem with prices. According to a CNBC survey from May 2022, two-thirds of American workers have not seen their wages rise enough to keep up with inflation.

A poll also conducted in May 2022 showed the striking result that 49% of Americans would not be able to cover an unexpected $400 expense. That is up from 40% in 2019. It demonstrates that whatever increased savings many Americans had from the stimulus checks sent out in 2020 and 2021 are now largely or entirely depleted.

Source: CNBC

Perhaps worse, a recent LendingClub report found that 61% of Americans lived paycheck to paycheck in June, up from 58% in May and 55% in the Summer of 2021.

This problem of American households living paycheck to paycheck with little to no savings may be true of many middle-class families, but it is most pronounced among the poor. As prices of everyday items rise, it is the lowest income households who have the hardest time absorbing these increases.

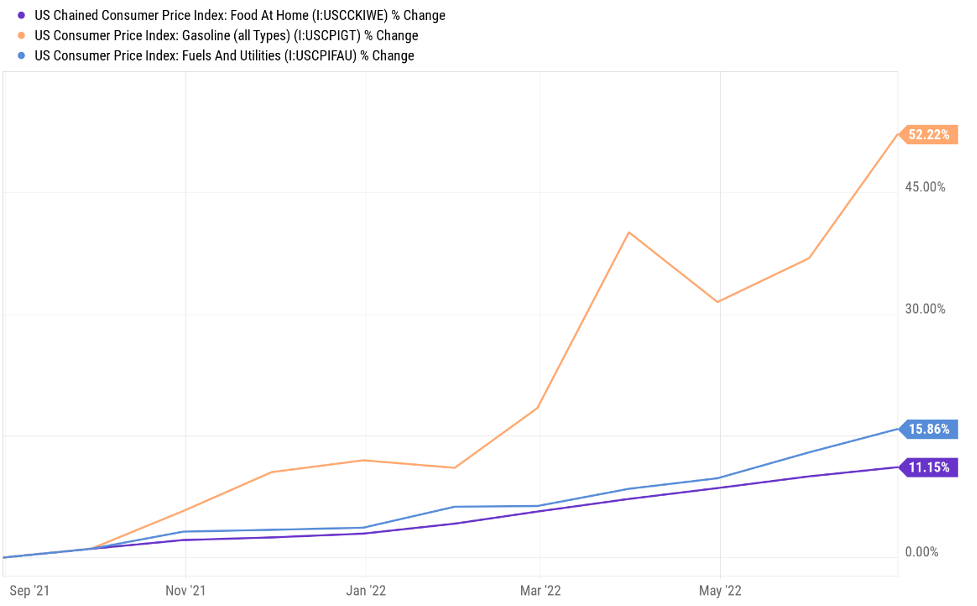

Consider necessities like groceries, gasoline, utilities, and rent. The prices of all of these have soared in the last year.

In fact, in June, the "food at home" component of the CPI rose at its fastest trailing 12-month rate since 1979, while the price of gasoline rose at its fastest 12-month rate since 1980. Meanwhile, the electricity price index, which reflects the amount paid in utility bills, experienced its largest increase since 2006.

That last point is particularly painful for Texans experiencing week after week of over-100-degree heat. Air conditioners are working harder and using more power while the cost of that power is rising. It's a miserable double-whammy for the low-income household.

Food costs are no different. Everyone has to eat, but not everyone spends an equal share of their income on food. Though higher income households spend around three times more on food, they also have significantly higher incomes such that the portion of their income going toward food is much smaller than it is for low-income households.

And this chart uses data from 2020, before inflation began to take off! Lower income households are likely spending an even greater portion of their income on food today than they did two years ago.

The same goes for gasoline. In 2019, when gas prices were much lower than they are today, the lowest income households spent 4.5 times more of their income on gasoline than the highest income households.

Source: Axios

Low-income individuals tend to drive older, less fuel-efficient cars, which makes spikes in gas prices more painful for them.

Moreover, low-income workers are less likely than higher income workers to be able to work remotely or from home, which means that they have less ability than the average higher income worker to avoid paying those high gas prices in order to get to work.

But the biggest expense for most low-income households is rent. Though apartment rent rates experienced a brief period of mildly declining rent during the pandemic, they have since surged at the fastest growth rates seen in decades. Starting in late 2021, rent rates have been climbing by 15-17% on average.

Very few workers have seen their incomes rise that fast. As such, renters are seeing ever larger percentages of their income go toward housing as their leases roll over from year to year or from month to month.

Where OnRamp fits in

To use a bad analogy, low-income households are like a car stuck in "reverse." They would like to move forward and improve their financial situation by increasing their savings. But that is nearly impossible when they are forced to stretch every dollar further and further to make ends meet.

This situation is especially pernicious when prices of everyday items like groceries, gas, utilities, and rent are rising as rapidly as they are today. Inflation is a silent thief, and it is the poor who had the least to lose to begin with.

For many of the working poor, this feels like a hopeless situation. It seems as though they will drown under rising prices and mounting credit card debt as their wages fail to keep up. The dream of escaping the grind of living paycheck to paycheck may seem like just that - an unattainable dream.

At OnRamp, we believe that our purpose is not just to provide cars, but to provide hope. For those in need, receiving a reliable vehicle can be a tremendous blessing. And as discussed in "Return on investment: the case for businesses investing in OnRamp," that gift is very often one that keeps on giving to the recipient and the entire community.

Consider this. A reliable vehicle allows a worker to:

Get to work on time so as not to lose wages

Go to healthcare appointments, reducing the number of sick days

Find a new job that was previously unattainable due to lack of reliable transportation

Move to a new city or neighborhood with better job opportunities

Build up savings to be able to handle an unexpected expense

And this is not even to mention non-monetary benefits such as finally attending kids’ school and community events, church, family reunions, vacations and all the other occasions that make life fulfilling.

We simply wish to highlight the way in which receiving a reliable vehicle can be a major game-changer for a low-wage worker in an inflationary environment such as the one in which we find ourselves today. Owning a car has the power to shift someone's life and financial situation from "reverse" into "drive." Along with this shift comes the hope for a better future.

At OnRamp, we believe this hope is a symbol of the hope for an abundant life we find in Jesus Christ. It is that hope that drives us to do this work every day!